Financial Health in Challenging Times

Hello friends and colleagues! I hope this correspondence finds everyone doing well, staying safe and healthy!

A statistic that we have frequently referenced in the past indicated that over 60% of Americans didn’t have the savings to cover a $500 emergency. Obviously, none of us knew that we were on the precipice of a significant event that would throw the whole world into economic disarray. It is anticipated that the financial and economic implications of the lockdowns and government stimulus packages may impact us for a decade or more. As a result, the financial and economic stress, as well as potential trauma of this event is something we take very seriously at FHI.

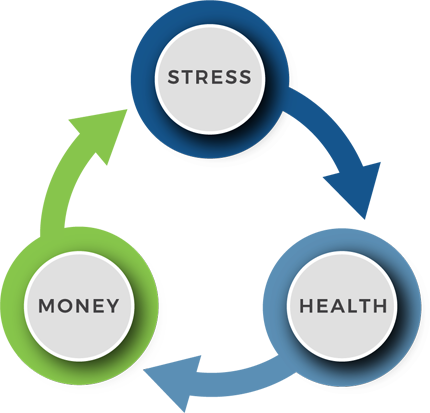

Money-Stress-Health

Our origins as an organization were steeped in the Great Recession following the housing bubble crisis of 2008. The recognition of the relationship among money, stress and health became the foundation for all of the work that FHI has done since then.

As the world goes through another enormous crisis—and with so many unknowns around the micro and macro economic situations—I believe that once again it is incumbent upon us to emphasize the importance of financial health.

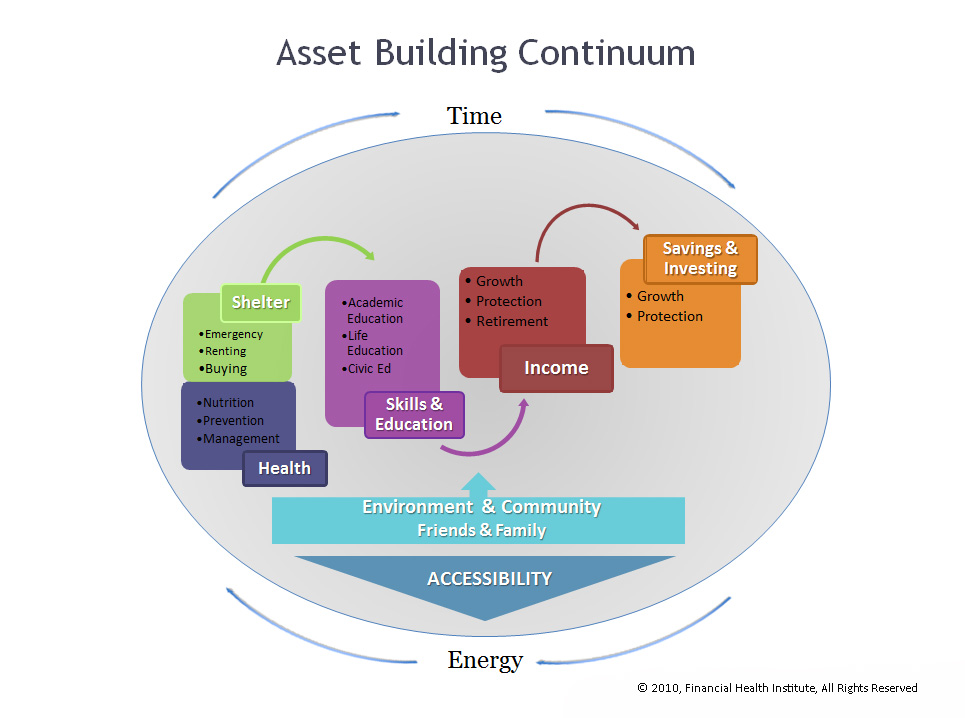

In 2012, as a result of the work we had been doing in the field, FHI developed its own definition of “financial health”. As we define it, financial health takes into account a person’s full economic picture, and not necessarily just their money situation. This emerged from a model we developed that we call the Asset Building Continuum.

This model, we feel, is a better way for a person to envision their economic situation and to be able to begin working on their assets as a means of financial and economic stabilization, as opposed to just giving someone a budget, or telling them to save more money.

Rebuilding our Financial Health

Perhaps now, more than ever, as we attempt to rebuild on so many levels, it is a good idea to get back to the basics of financial health. In my personal opinion, for what it is worth, I think that “belief” is where we have to start! We have to believe that it is possible for us to rebuild, lest we lack the spirit to move forward. And It is definitely a time for us to fully explore all of our assets again because this will assist us in our beliefs and begin to move us out of feelings of scarcity.

A Gift for You

Over the next several months, FHI will be launching new packages of trainings and strategies to implement them. We’ll keep you posted on those developments as they unfold. In the meantime, we have developed an online training specifically for this moment, titled Financial Wellness in Challenging Times (click on the title to see the course). We would like to offer it to you at no cost for the next month. We ask for your feedback, thoughts, feelings and ideas on this course—and, as always, how can we make it better to serve you.